1. The Macro-Strategic Landscape: A Paradigm Shift in Precious Metals

The global financial architecture is currently navigating a period of profound transformation, a “multidimensional polarization” that has fundamentally altered the valuation models for precious metals. As we conclude the calendar year 2025 and pivot toward 2026, the gold market in India finds itself at a historic inflection point. The traditional inverse correlation between risk assets and gold has frayed, replaced by a new regime where gold rallies in concert with equities, driven by a debasement of fiat currency trust and a structural realignment of global central bank reserves.

The year 2025 will likely be recorded in economic history as the year of the “Great Breakout,” a period where gold prices in India shattered the psychological ceiling of ₹14,000 per gram for 24-karat purity, a level that would have been dismissed as hyper-bullish merely twenty-four months prior. This report offers an exhaustive analysis of this new paradigm, dissecting the intricate web of domestic demand, regulatory intervention, and global macroeconomic forces that are projected to drive gold prices toward the ₹1.75 lakh per 10-gram mark by 2026.

1.1 The “Perfect Storm” of 2025: Anatomy of a Rally

To forecast the trajectory for 2026 and beyond, one must first deconstruct the unprecedented rally of late 2025. The surge in gold prices—rising approximately 43.79% in the six months leading up to December 2025 and nearly 80% year-on-year—was not a function of a single catalytic event but rather the convergence of long-term structural forces.

Analysts at LKP Securities and other financial institutions have characterized this as a “generational rally,” distinct from the cyclical upswings of the past two decades. The primary drivers were a rare alignment of macroeconomic stress points: persistent geopolitical tensions in Eastern Europe and the Middle East, elevated government debt levels in major Western economies raising concerns over fiscal sustainability, and a weaponization of trade tariffs that fragmented global supply chains.

In this environment, gold transitioned from a mere portfolio diversifier to a “debasement hedge.” The market began to price in not just inflation, but the potential erosion of the purchasing power of the US Dollar and other reserve currencies. This sentiment was exacerbated by the aggressive accumulation of bullion by central banks, most notably the Reserve Bank of India (RBI) and the People’s Bank of China (PBoC), effectively putting a “sovereign floor” under the price of gold.

1.2 The Current Valuation Regime (December 2025)

As of December 30, 2025, the Indian gold market has consolidated at historic highs. The spot price for 24-karat gold (99.9% purity) is trading firmly in the range of ₹13,924 to ₹14,204 per gram across major metropolitan centers. This pricing structure reflects a mature bull market where dips are aggressively bought, signaling strong underlying demand despite the optical shock of high prices.

The regional dispersion of prices offers critical insights into the micro-structure of the Indian market. Chennai, a hub for jewelry consumption, consistently commands a premium, with 24K prices touching ₹14,204 per gram, significantly higher than the ₹13,924 observed in Mumbai and Kolkata. This premium is indicative of the inelastic demand for physical gold in Southern India, where gold is deeply entrenched in cultural and religious rites, rendering it less sensitive to price spikes compared to the more investment-oriented markets of the North and West.

Table 1: Comparative Gold Rate Matrix Across Major Indian Cities (Dec 30, 2025)

| City | 24K Gold Rate (₹/10g) | 22K Gold Rate (₹/10g) | Spread (24K – 22K) | Market Characterization |

| Chennai | ₹1,42,040 | ₹1,30,200 | ₹11,840 | High retail jewelry demand; consistent price premium. |

| Mumbai | ₹1,41,710 | ₹1,29,900 | ₹11,810 | Financial hub; sets the national benchmark; high ETF activity. |

| Delhi | ₹1,41,860 | ₹1,30,050 | ₹11,810 | Driven by wedding season demand and speculative trade. |

| Kolkata | ₹1,41,710 | ₹1,29,900 | ₹11,810 | Price taker; sensitive to rural agricultural income cycles. |

| Bangalore | ₹1,41,710 | ₹1,29,900 | ₹11,810 | Growing digital gold adoption; mimics Mumbai rates. |

| Hyderabad | ₹1,41,710 | ₹1,29,900 | ₹11,810 | Strong convergence with Southern pricing trends. |

| Bhopal | ₹1,40,450 | ₹1,28,750 | ₹11,700 | Tier-2 benchmark; slightly lower overhead costs reflected in price. |

Data aggregated and synthesized from GoodReturns, Times of India, and local bullion association reports.

The stability of the spread between 24K and 22K gold—hovering around ₹1,180 per gram—is a vital metric. 22K gold, alloyed with copper, zinc, or silver, constitutes the bulk of jewelry purchases. The fact that 22K prices have breached the ₹1.3 lakh per 10g mark without precipitating a collapse in demand suggests a fundamental recalibration of the Indian consumer’s price expectations. The “wait-and-watch” approach typically seen during price spikes has evolved into a “fear-of-missing-out” (FOMO) psychology, where households are accelerating purchases in anticipation of further rallies.

2. The Engine Room: Global Macroeconomic Drivers for 2026

The trajectory of gold prices in India is inextricably linked to global macroeconomic currents. While domestic demand provides a floor, the ceiling is determined by international spot prices (XAU/USD) and the USD/INR exchange rate. As we look toward 2026, three primary engines are driving the bullish thesis: the Federal Reserve’s monetary pivot, the “Risk Premium” of geopolitics, and the accelerating trend of de-dollarization.

2.1 The Federal Reserve and the Real Rate Reversal

The single most potent driver of gold prices historically has been the direction of US real interest rates. Gold, a non-yielding asset, typically underperforms when real rates (nominal interest rates minus inflation) are high, as investors prefer the guaranteed yield of US Treasuries. However, the outlook for 2026 is predicated on a reversal of this dynamic.

J.P. Morgan Global Research projects a bullish environment for gold in 2026, driven by the expectation of a sustained rate-cutting cycle by the Federal Reserve. The rationale is that as the US labor market cools and inflation stabilizes, the Fed will be forced to lower nominal rates to support growth. Historically, gold prices tend to embark on sustained rallies starting approximately four months after the first Federal Reserve rate cut.

However, the 2026 scenario is unique because inflation is expected to remain “sticky,” hovering above the Fed’s 2% target due to structural supply chain inefficiencies and deglobalization. If nominal rates fall while inflation remains elevated, real interest rates will decline, potentially turning negative. In a negative real rate environment, the opportunity cost of holding gold evaporates, making it the preferred store of value over depreciating cash or low-yielding bonds. This monetary easing cycle is a core component of the forecasts predicting gold to reach $4,400–$5,000 per ounce by late 2026.

2.2 The Geopolitical “Risk Premium” and Multidimensional Polarization

The world in 2026 is described by analysts as being in a state of “multidimensional polarization”. This refers to a fragmented geopolitical landscape characterized by active conflicts (Russia-Ukraine, instability in the Middle East), trade wars (US-China tariff escalations), and the breakdown of multilateral cooperation.

In 2025, geopolitical tensions were not merely background noise but active drivers of price action. The “risk premium” embedded in gold prices has expanded. Investors and sovereign entities are increasingly viewing gold as a “stateless currency”—an asset that is not the liability of any other counterparty and cannot be frozen by sanctions, unlike US Treasury bonds or SWIFT-mediated deposits.

The World Bank and other multilateral institutions have cited these “heightened geopolitical risks” as a primary reason for their bullish outlooks extending through 2026. This demand is structurally different from speculative demand; it is strategic and inelastic. When a central bank buys gold to sanction-proof its reserves, it is unlikely to sell that gold merely because the price has risen by 10%. This removes a significant amount of floating supply from the market, tightening the physical availability of bullion.

2.3 The USD/INR Multiplier Effect

For the Indian consumer and investor, the global spot price is only half the equation. The value of the Indian Rupee (INR) against the US Dollar (USD) acts as a critical multiplier. Even if global gold prices were to remain stagnant, a depreciation of the INR would result in higher domestic gold prices.

Forecasting the USD/INR pair for 2026 reveals a divergence in analyst views, creating a spectrum of potential outcomes for the landed cost of gold:

- The Bullish Rupee Scenario: ING Bank forecasts a strengthening of the Rupee to approximately 87.00 INR/USD by the end of 2026. This view is predicated on strong Indian macroeconomic fundamentals, robust service exports, and potential inclusion in global bond indices driving capital inflows. In this scenario, the rise in domestic gold prices would be tempered, driven almost entirely by global spot price appreciation.

- The Bearish Rupee Scenario: Conversely, technical models from Wallet Investor predict a trend of depreciation, with rates potentially reaching 93.21 by late 2026 and crossing 100 by 2030. This view factors in India’s persistent trade deficit, inflation differentials with the US, and the high import bill for energy and electronics.

If the bearish scenario materializes and the Rupee slides toward 93, it will act as a “turbocharger” for domestic gold prices. For example, a global gold price of $4,500/oz combined with a USD/INR rate of 93 would propel domestic prices significantly higher than the same spot price at an exchange rate of 87. This currency risk is a key reason why Indian financial advisors recommend maintaining gold allocation—it acts as a natural hedge against the depreciation of domestic purchasing power.

3. The Central Bank Pivot: The Strategic Accumulation of 2026

One of the most defining characteristics of the post-2022 gold market is the aggressive return of central banks as net buyers. This trend, which accelerated in 2024 and 2025, is projected to be a dominant force in 2026, fundamentally altering the supply-demand balance.

3.1 The Reserve Bank of India (RBI): Building a Golden Fortress

The Reserve Bank of India has emerged as a proactive protagonist in this global shift. Data from late 2025 indicates that the RBI’s gold reserves have surged past 880 metric tonnes, a strategic accumulation that has seen the value of these holdings cross the $95 billion threshold.

This accumulation is not a passive exercise in diversification but a deliberate strategic maneuver. By adding approximately 75 tonnes since early 2024, the RBI has increased the share of gold in its total foreign exchange reserves to nearly 14%. This signals a long-term commitment to enhancing the resilience of India’s external balance sheet against global volatility.

The RBI’s behavior in the third quarter of 2025—holding reserves steady at ~880 tonnes despite record-high prices—indicates that the central bank is not a “fair-weather buyer” looking to trade for profit. Instead, it views gold as a strategic anchor. Analysts at Morgan Stanley note that this reflects a broader trend among emerging market central banks to reduce exposure to the US Dollar (“de-dollarization”) and strengthen monetary sovereignty.

3.2 Global Official Sector Demand

The RBI is not acting in isolation. J.P. Morgan Global Research projects that central bank demand globally will average around 755 tonnes in 2026. This relentless buying pressure creates a “sovereign put” option under the gold price.

Historically, central banks were price-sensitive buyers, stepping back when prices rose. The behavior observed in 2025 and forecasted for 2026 turns this logic on its head; central banks are buying into the rally. This change in behavior is driven by the need to diversify reserves away from fiat currencies that are vulnerable to inflation and sanctions. The “fear of weaponization” of dollar reserves, following the freezing of Russian assets in 2022, has fundamentally changed the risk calculus for reserve managers in China, India, Turkey, and other Global South nations.

This structural demand absorbs a significant portion of annual mine production, leaving less available for private investment and jewelry consumption. J.P. Morgan notes that roughly 350 tonnes of net quarterly demand is needed to support rising prices; current projections of 585 tonnes per quarter in 2026 (from investors and central banks combined) suggest a tight market poised for further appreciation.

4. Price Forecasts and Scenario Planning: 2026-2030

The convergence of these drivers leads to a consensus among financial institutions that 2026 will see gold prices testing uncharted territory. However, the magnitude of these gains depends on specific scenario realizations.

4.1 Global Institutional Targets (USD/oz)

Major global banks have revised their forecasts upward, reflecting the resilience of the bull market. J.P. Morgan’s outlook is particularly aggressive, projecting a steady climb throughout the four quarters of 2026.

Table 2: Quarterly Gold Price Forecasts 2026 (Global Consensus)

| Quarter | J.P. Morgan Forecast (USD/oz) | LiteFinance Forecast (USD/oz) | Key Drivers & Market Sentiment |

| Q1 2026 | $4,400 | $8,463 – $10,157 (High Variance) | Consolidation of 2025 gains; reaction to initial Fed rate cuts. |

| Q2 2026 | $4,655 | $8,551 – $9,823 | Acceleration phase; real rates moving deeper into negative territory. |

| Q3 2026 | $4,860 | $8,569 – $9,559 | Seasonal demand pick-up; potential escalation in trade tariffs. |

| Q4 2026 | $5,055 | $8,708 – $10,141 | Testing the psychological $5,000 barrier; peak central bank buying. |

Sources: J.P. Morgan Global Research , LiteFinance Analyst Consensus. Note: LiteFinance targets appear extraordinarily high and may represent a hyper-inflationary scenario, whereas J.P. Morgan represents the institutional consensus.

The J.P. Morgan forecast implies a linear ascent, suggesting that pullbacks will be shallow and short-lived. The projection of $5,055/oz by Q4 2026 represents a significant appreciation from the ~$4,350 levels seen in late 2025.

4.2 Domestic Price Scenarios (INR/10g)

Translating these global targets into the Indian context requires factoring in import duties (currently 6%, but subject to change) and the USD/INR exchange rate. Domestic analysts, including those from Kotak Securities and Goldman Sachs (India), have provided ranges that account for these variables.

Scenario A: The Base Case (Moderate Bull)

- Assumptions: Gold trades at ~$4,600/oz; USD/INR stabilizes at ~89-90; Import duty remains stable.

- Price Target: ₹1,28,000 – ₹1,38,000 per 10 grams.

- Implication: A steady grind higher, delivering inflation-beating returns but without explosive volatility.

Scenario B: The Super-Cycle (Strong Safe-Haven)

- Assumptions: Gold breaches $5,000/oz; USD/INR depreciates to ~93; Geopolitical conflict escalates.

- Price Target: ₹1,50,000 – ₹1,75,000 per 10 grams.

- Implication: This is the scenario favored by Kotak Securities. It envisions gold becoming the primary asset class for wealth preservation, outperforming equities in risk-adjusted terms.

Scenario C: The Long-Term Horizon (2030)

- Forecast: Looking beyond 2026, the structural bull market could push prices to the ₹1.62 lakh – ₹2.0 lakh range by 2030.

- Implication: This long-term view reinforces the strategy of holding gold as a generational asset rather than a short-term trade.

Table 3: Long-Term Price Forecasts (2026-2030) – INR per 10 grams

| Year | Base Case (Moderate Growth) | Bull Case (Crisis/High Demand) | Bear Case (Dollar Resurgence) |

| 2026 | ₹1,28,000 – ₹1,38,000 | ₹1,47,900 – ₹1,75,000 | ₹1,06,900 |

| 2027 | ₹1,35,000 – ₹1,47,000 | ₹1,62,040 | ₹1,06,030 |

| 2028 | ₹1,43,000 – ₹1,57,000 | ₹1,75,414 | ₹1,05,036 |

| 2029 | ₹1,52,000 – ₹1,68,000 | ₹1,90,204 | ₹1,03,911 |

| 2030 | ₹1,62,000 – ₹1,80,000 | ₹2,04,607 | ₹1,02,657 |

Data synthesized from EBC Forex, Attica Gold, and Kotak Securities projections.

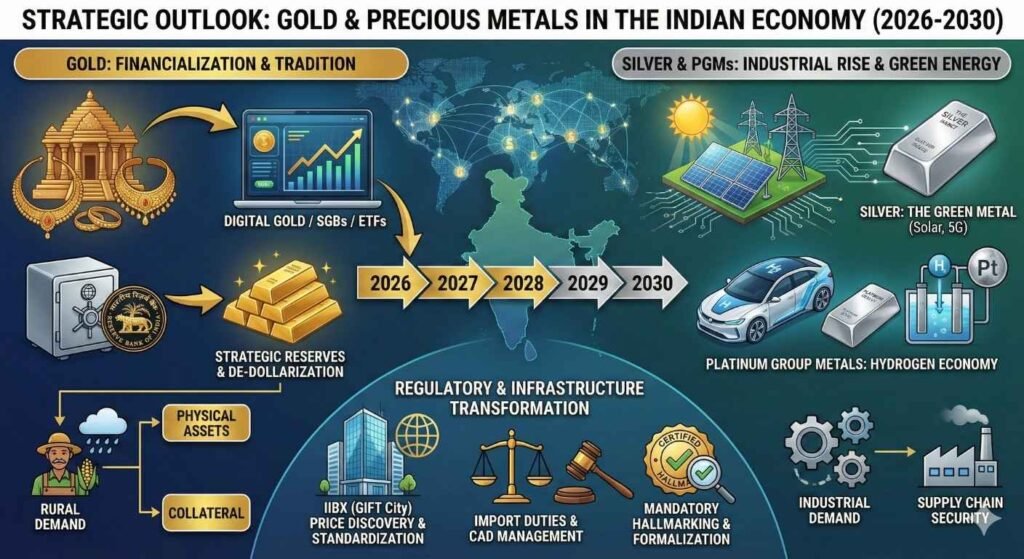

5. The Silver Tsunami: A High-Beta Opportunity

While gold commands the narrative as a safe haven, silver is emerging as the “high-beta” opportunity for 2026. Often referred to as “gold’s volatile cousin,” silver is positioned to benefit from a dual tailwind: monetary correlation with gold and a massive industrial supply deficit.

5.1 The Industrial Supply Squeeze

Unlike gold, which is primarily held for investment and jewelry, over 60% of silver demand is industrial. It is a critical component in the green energy transition, essential for Photovoltaic (PV) solar cells, Electric Vehicles (EVs), and 5G electronics.

- Deficit Dynamics: 2025 marked the fifth consecutive year of silver supply deficits, with the shortfall estimated at 117 million ounces. Mine production has remained stagnant at roughly 813 million ounces annually, while industrial demand continues to set new records.

- Strategic Vulnerability: The market is facing a potential supply shock from China, the world’s largest consumer and processor of silver. New export restrictions or increased domestic stockpiling by China could exacerbate the global shortage, driving prices parabolically higher.

5.2 Price Forecasts for Silver (2026)

The rally in silver has been explosive, with prices rising 174% in 2025. Analysts predict this momentum will carry into 2026, potentially outperforming gold in percentage terms.

- Global Target: Analysts at Reliance Securities and other firms predict Comex silver could reach $100 per ounce in 2026, driven by the industrial squeeze.

- Domestic Target: On the MCX, forecasts suggest silver could trade in the range of ₹2.42 lakh – ₹2.60 lakh per kg.

- Implication: For investors with a higher risk tolerance, silver offers a compelling proposition. However, the volatility is significantly higher; a 20% correction in silver is common during a bull run, whereas gold typically corrects by 5-10%.

6. Regulatory Horizons: The Union Budget 2026

Government policy remains the single largest “event risk” for the Indian gold market. The upcoming Union Budget 2026 is the subject of intense speculation, with the debate centering on the direction of import duties.

6.1 The Duty Hike Debate: Deficit vs. Smuggling

The Indian government faces a classic policy dilemma. On one hand, gold imports act as a massive drain on foreign exchange, widening the Current Account Deficit (CAD) and putting pressure on the Rupee. On the other hand, high duties incentivize smuggling, creating a parallel “grey market” that evades taxes and funds illegal activities.

- The Case for a Hike: Reports indicate that the government is considering raising customs duties on “non-essential” items to narrow the trade deficit and promote domestic manufacturing. Gold, often classified as a non-essential luxury by policymakers, is a prime candidate for such a hike. A duty increase would immediately increase the landed cost of gold, causing an overnight spike in domestic prices.

- The Industry Rebuttal: The World Gold Council (WGC) and the India Bullion & Jewellers Association (IBJA) have strongly advocated against any duty hike. They argue that the duty reduction in July 2024 (from 15% to 6%) successfully reduced smuggling and brought volume back into official channels. They warn that reversing this policy would be regressive, pushing the industry back into the shadows and harming the organized jewelry sector which employs millions.

6.2 Structural Reforms and “Atmanirbhar” Gold

Beyond the binary duty debate, Budget 2026 is expected to introduce structural reforms aimed at financializing gold holdings:

- Revamping the Gold Monetization Scheme (GMS): There is a renewed push to mobilize the estimated 25,000+ tonnes of idle gold held by Indian households. The GJC (Gem & Jewellery Council) has recommended revamping the GMS to make it more attractive to banks and consumers, effectively treating household gold as a “domestic mine” to reduce import dependence.

- Digital Infrastructure: Expectations are high for policies that support the digital gold ecosystem, potentially integrating it more tightly with the formal financial sector. This aligns with the government’s broader push for a $5 trillion economy and digital financial inclusion.

- Manufacturing Incentives: To boost exports, the budget may offer tax holidays or reduced duties on capital goods for jewelry manufacturing, aiming to position India as a “jewelry factory to the world” rather than just a consumer.

7. Investment Ecology: Strategy for the Indian Investor

In light of the projected “Super Cycle,” the investment strategy for Indian households and institutions must evolve. The traditional approach of passive accumulation is being replaced by active portfolio management.

7.1 Asset Allocation: Gold vs. Equities

A key question for 2026 is the relative performance of Gold versus the Nifty 50.

- The Equity Case: Market strategists like Rohit Srivastava are bullish on Indian equities, predicting the Nifty could hit 33,000 by the end of 2026. This would be driven by corporate earnings growth and India’s GDP expansion.

- The Gold Case: Gold is expected to perform as a “crisis alpha” asset. While equities thrive on growth, gold thrives on uncertainty. Given the geopolitical risks and potential for currency debasement, gold acts as insurance for the equity portfolio.

- Synthesis: Financial advisors recommend a balanced approach. Gold should not be seen as a competitor to equities but as a stabilizer. A 10-15% allocation to precious metals is recommended to reduce overall portfolio volatility while capturing the upside of the commodity cycle.

7.2 The Investment Vehicle Matrix

The choice of how to own gold is as important as when to buy.

| Vehicle | Pros | Cons | Strategic Fit for 2026 |

| Sovereign Gold Bonds (SGB) | 2.5% annual interest; Tax-free redemption; No purity risk. | Lock-in period (5-8 years); Issuance frequency uncertainty. | Best for Long-Term Wealth: If the government issues new tranches in 2026, this remains the superior vehicle for tax-efficient compounding. |

| Gold ETFs | High liquidity; Low spread; Easy storage (Demat). | Expense ratio (though low); Capital gains tax applies. | Best for Tactical Trading: Ideal for capturing short-term swings (e.g., buying dips at ₹1.38L) without physical delivery hassles. |

| Physical Jewelry | Utility value (adornment); Cultural significance. | High making charges (10-20%); Lower resale value due to wastage. | Best for Consumption: Not an efficient investment vehicle, but remains the primary driver of demand due to weddings/festivals. |

| Digital Gold | Fractional ownership (buy for ₹100); Ease of access. | GST loss on purchase; Spread between buy/sell prices is high. | Best for Small Savers: Useful for systematic accumulation (SIPs) for those who cannot afford ETFs or Bonds. |

7.3 Consumer Psychology: The “Hoarding” Paradox

A fascinating trend observed in late 2025 is the breakdown of the “recycling” mechanism. historically, when prices hit record highs, Indian households would sell old jewelry to monetize gains (recycling). However, current data suggests that recycling volumes have remained low despite record prices.

- The Shift: This indicates a psychological shift. Consumers are treating gold not as a source of emergency cash but as an appreciating asset they are afraid to sell (FOMO). They believe prices will go higher, so they hoard rather than sell.

- Implication: This behavior tightens domestic supply. If households refuse to recycle old gold, the industry is forced to import more fresh bullion to meet demand, keeping premiums high and supporting the price floor.

8. Conclusion: Navigating the Golden Era

The analysis of data from global banking giants, domestic market behavior, and geopolitical trends converges on a singular conclusion: The gold bull market is structurally intact and likely to accelerate in 2026.

We are witnessing the unfolding of a “Super Cycle” in precious metals, driven by the debasement of fiat currency, the weaponization of the global financial system, and the strategic realignment of central bank reserves. For the Indian economy, this presents both challenges (higher import bills, inflation pass-through) and opportunities (wealth creation for holders, Sovereign Gold Bond returns).

Final Strategic Outlook:

- Price Targets: Expect gold to trade firmly in the ₹1.50 lakh – ₹1.75 lakh per 10 grams range by late 2026. Silver serves as a high-risk, high-reward satellite holding.

- Policy Watch: Be prepared for volatility around the Union Budget (February 2026). A duty hike is a distinct possibility and would be bullish for domestic inventory holders.

- Actionable Advice: The era of “cheap gold” is likely over. Investors should utilize the “buy-on-dips” strategy, targeting accumulation near ₹1,37,000-₹1,38,000 levels , and hold with a horizon extending to 2030. In a world of multidimensional polarization, gold remains the ultimate anchor.

Appendix: Comprehensive Data Tables

Table A: Detailed Forecast Aggregation (2026)

Source: J.P. Morgan, Goldman Sachs, Kotak Securities, LiteFinance

| Institution | 2026 Price Target (Global) | 2026 Price Target (India Implied) | Methodology / Key Driver |

| J.P. Morgan | $4,400 – $5,055 / oz | ₹1.45L – ₹1.65L / 10g | Fed cuts + Central Bank demand (585t/qtr). |

| Goldman Sachs | ~$4,870 / oz | ₹1.55L – ₹1.60L / 10g | “Fear” trade + ETF inflows. |

| Morgan Stanley | $4,400 / oz | ₹1.40L – ₹1.45L / 10g | Base case; lower geopolitical escalation. |

| Kotak Securities | N/A | ₹1.50L – ₹1.75L / 10g | Currency depreciation + Strong safe-haven demand. |

| LiteFinance | $8,400+ (Outlier) | >₹2.50L (Outlier) | Hyper-inflationary / Crisis scenario. |

Table B: RBI Gold Reserve Growth Trajectory

Source: RBI Data, Morgan Stanley Reports

| Timeline | Total Reserves (Metric Tonnes) | Value (USD Billion) | % of Forex Reserves | Analysis |

| Early 2024 | ~805 tonnes | ~$70 B | ~9% | Pre-rally accumulation phase. |

| Q2 2025 | 880 tonnes | ~$90 B | ~12.5% | Aggressive buying despite price rise. |

| Q3 2025 | 880.18 tonnes | ~$95 B | ~13.5% | Holding steady; valuation surge. |

| Late 2025 | >880 tonnes | >$100 B | ~14% | Strategic target achieved; creating a floor. |

Disclaimer: This research report is intended for informational purposes only. The forecasts contained herein are based on market analysis and historical data, which are subject to change. Precious metals are volatile assets. Investors should conduct independent due diligence and consult with certified financial planners before making investment decisions.jpmorgan.comA new high? | Gold price predictions from J.P. Morgan Global …Opens in a new windowgoodreturns.inOpens in a new windowgoodreturns.inGold Rate Today (30 December 2025), Gold Price in India – GoodreturnsOpens in a new windowgripinvest.inGold Price Prediction for 2026: Will Gold Hit INR 1.5–1.75 Lakh? – Grip InvestOpens in a new windowgoldprice.orgGold Price IndiaOpens in a new windowbusiness-standard.comGold, Silver outlook for 2026: Precious metals brace for consolidationOpens in a new windowm.economictimes.com$5 trillion in gold? At record high prices, India’s household gold could now be bigger than GDPOpens in a new windowtimesofindia.indiatimes.comGold price today: How much the yellow metal costs in Delhi, Mumbai & other cities; check rates for 22K, 24K goldOpens in a new windowgoodreturns.inGold Rate Today (29 December 2025), Gold Price in India – GoodreturnsOpens in a new windowtimesofindia.indiatimes.com